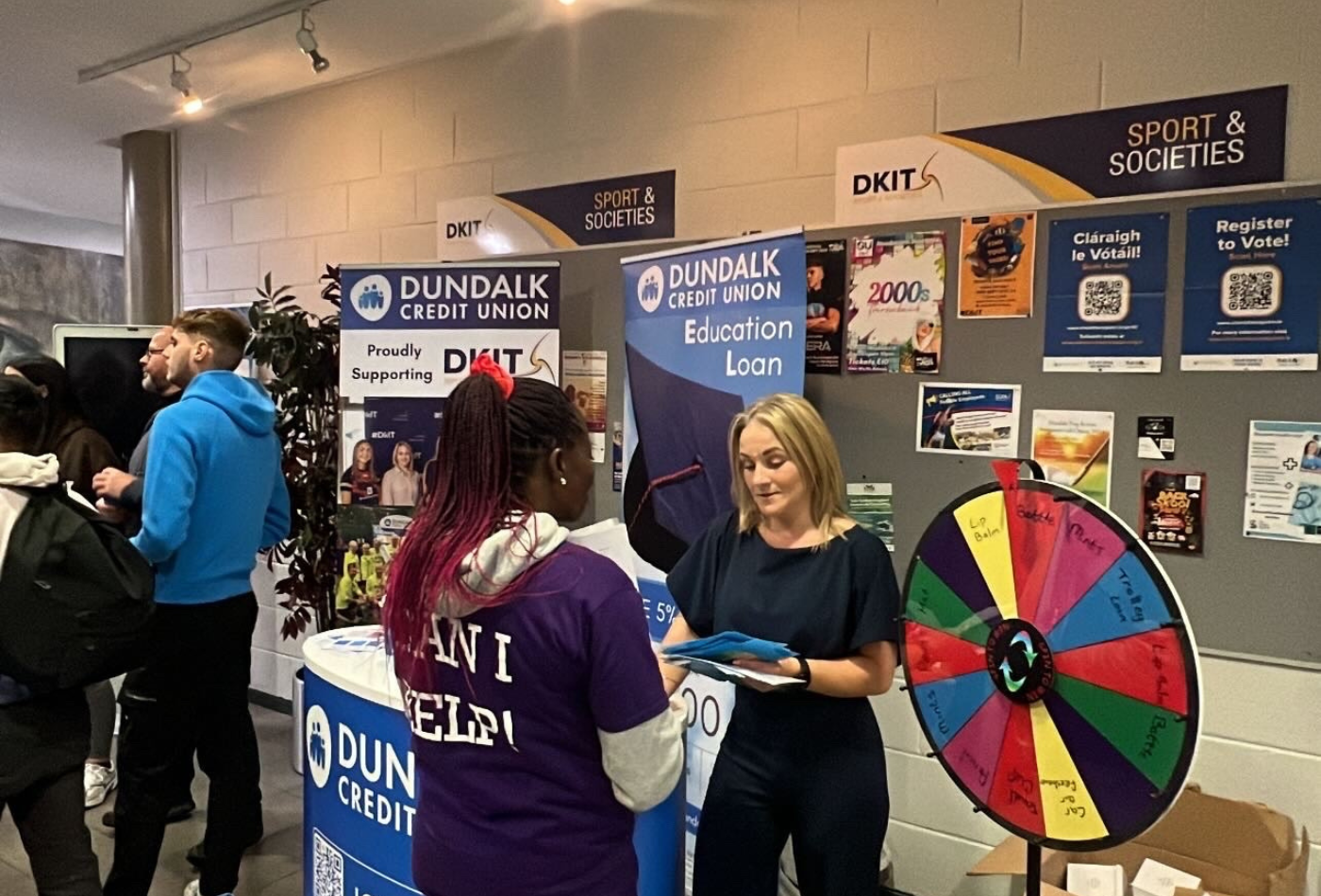

Freshers’ Week at Dundalk Institute of Technology (DkIT) was a buzz of excitement last week. Dundalk Credit Union was thrilled to be on campus, collaborating with the Students’ Union in a new partnership aimed at supporting students’ financial wellness.

Throughout the week, the team—led by Victoria and Naomi—engaged with hundreds of students, particularly new first-years, eager to get involved in campus activities. Among the highlights was the Financial Wellness Wheel of Wisdom—a fun, interactive game designed to test students’ financial knowledge while offering essential insights into key money matters. Naomi O’Donoghue, Head of Sales and Business Development at Dundalk Credit Union, reflected on the experience:

“This wheel is always a big hit! It’s a great icebreaker, but it’s one of the best ways we’ve found to engage young people in financial topics which they may otherwise find dull. It’s a lot of fun, but we were surprised that over 95% of the students we met this week were unaware of what a money mule is. It is quite concerning, but we were able to spread the word to hundreds of students in a way that resonated with them, and we will continue to inform students throughout the year through on-campus participation”.

So, what exactly is a money mule? This is when an individual, often unknowingly, allows their bank account to be used to transfer money linked to criminal activities. Young people, including students, are often targeted by criminals, lured in with the promise of quick cash in exchange for allowing their account to be used. This may seem harmless at first glance, but money mule activity is illegal, and anyone caught participating—knowingly or not—can face serious consequences, including prosecution and losing access to banking services. Raising awareness about these scams is crucial, especially as they continue to evolve and target more vulnerable individuals.

Along with highlighting the dangers of money mules, the credit union team also discussed vital topics like debit card protection and fraud, budgeting, saving, and setting financial goals. Holly Lambe-Sally, Students Union’s President noted:

“We believe that supporting young people in understanding financial topics can have a lifelong impact, helping them to develop strong financial habits early on, that’s why we are delighted to partner with Dundalk Credit Union this year. Together, we are committed to helping our students become more financially savvy and we’re excited about the opportunities ahead.”